:max_bytes(150000):strip_icc()/etf_wood-5741f6683df78c6bb0ea6fad.jpg)

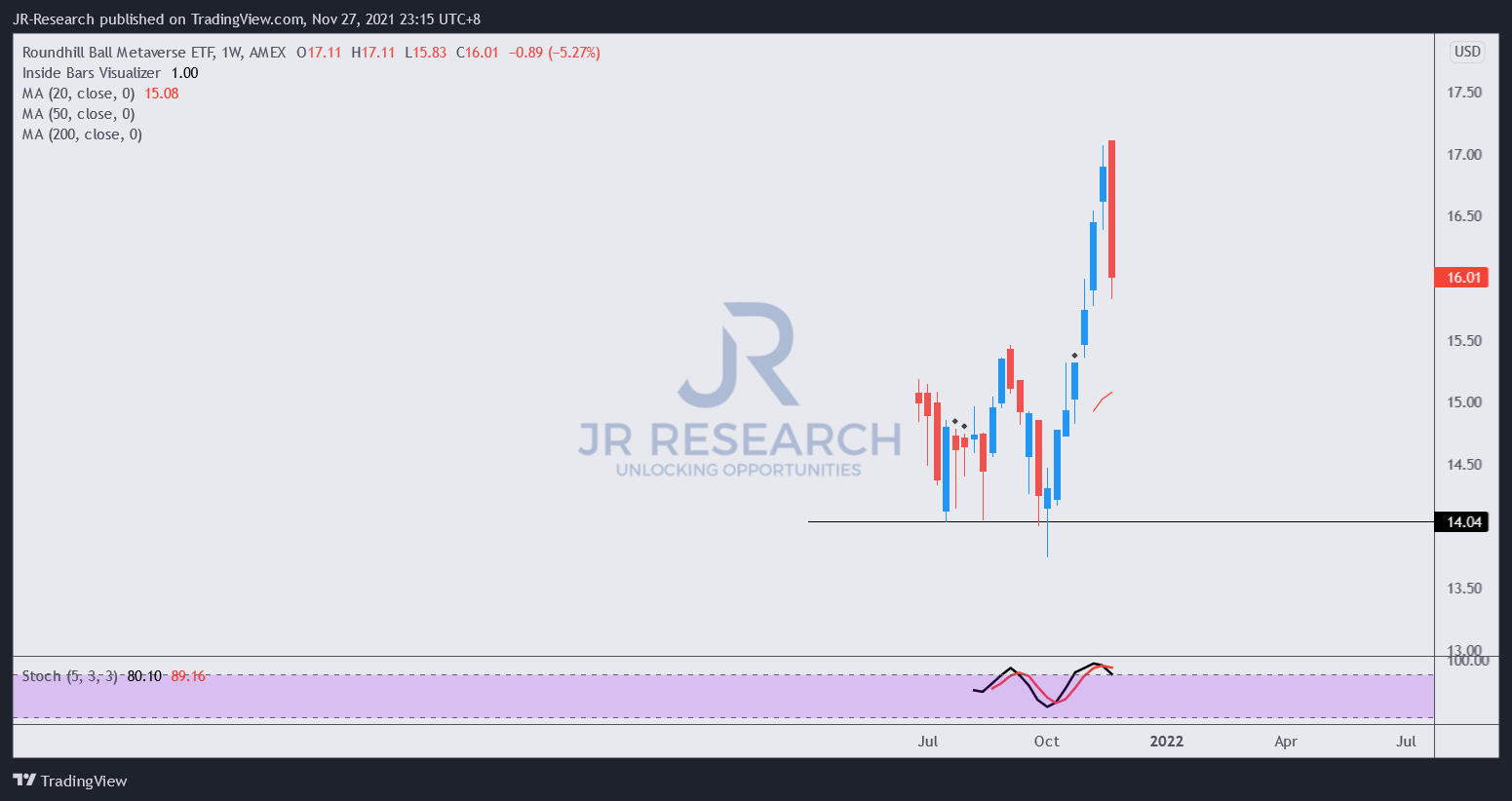

This compares to a 7.3% return for the Invesco QQQ Trust during a period defined by swings of volatility. With less than four months of trading history since the fund's inception, the Roundhill Ball Metaverse ETF is down 0.9% over the period. That said, the specific weighting allocations and key differences including the high profile of some small-cap stocks that are effectively overweighted relative to the market should give the META ETF a distinct risk profile and long-term return potential. The first observation from the holdings table above is that there is some overlap among the stocks in the META ETF to larger and more diversified tech-focused indexes funds like the NASDAQ-100 ( QQQ). (Source: Roundhill Investments) META ETF Performance ( U) round out the top 5 stocks in the META ETF together representing 34% of the funds weighting.

Meta etf companies software#

Roblox, Microsoft, Facebook, and Unity Software Inc. The company's leadership in graphics processing for computers is a critical component for the evolution of the Metaverse. is the largest current holding in the fund with an 8.3% weighting. From there, the weights are determined by a tiered system based on each company's relative importance within the categories, each capped at 25% of the total. Technically, META is meant to track the "Ball Metaverse Index" which utilizes a proprietary methodology and "expert council" to categorize companies between "pure-play", "core", and "non-core" on the Metaverse as it relates to their current business mix and outlook. (Source: Roundhill Investments) META ETF PortfolioĬurrently, the META portfolio has 41 holdings with a general thematic breakdown into categories including hardware, computing, networking, virtual platforms, interchange tools & standards, payment services, and content as representing the Metaverse. The other point here is that META is global, with about 20% of the current holdings represented by a non-U.S. These companies either power the infrastructure of the current virtual world or are likely well-positioned to lead with new technologies. For this reason, the META portfolio also invests in mega-cap companies like Facebook Inc., Nvidia Corp. This means that beyond what may be considered a "pure-play" on the Metaverse like Roblox, META also invests in more diversified large-cap tech companies that capture related tailwinds. The key to the META ETF is that it includes companies that help enable the Metaverse with some critical function. The Metaverse will be comprised of countless persistent virtual worlds that interoperate with one another, as well as the physical world, and generate a robust economy that spans labor and leisure, while transforming long-standing industries and markets such as finance and banking, retail and education, health and fitness, and more. The fund sponsor uses the following description. The expectation is that many of the concepts and communications formats can carry over into new types of virtual worlds beyond gaming. The idea of a virtual world operating with a digital currency is likely best demonstrated in the gaming platform and online community of "Roblox" from the Roblox Corporation ( RBLX). There is some hope that the segment accelerates over the next few years. ( FB ) made headlines with plans to invest significantly in Metaverse opportunities and even considered a name change to reflect this new focus. Without being dramatic, this is one of the hottest buzzwords in tech at least based on Google Trends.

The META ETF began trading in June of 2021, likely meeting a growing demand for the Metaverse as a new investing theme. We are bullish on the META ETF with its high-quality portfolio although it remains to be seen is if the ETF will be able to differentiate itself from broader technology funds and consistently outperform benchmarks. The META ETF was recently launched and we believe it does a good job of providing targeted exposure to themes like cloud computing, online gaming, payments, consumer electronics, and social networks as one unique strategy.

The "Metaverse" is the term used to describe the next stage in the evolution of the internet expected to represent a seamless experience between the digital and real world. The Roundhill Ball Metaverse ETF ( META) invests across a group of companies that are best positioned to benefit from the emergence of a virtual economy. MoMo Productions/DigitalVision via Getty Images

0 kommentar(er)

0 kommentar(er)